2025 Fsa Limits

For plan years beginning in 2025, the maximum amount that may be made newly available for the plan year for an excepted health reimbursement arrangement. The irs released 2025 contribution limits for medical flexible spending accounts (medical fsas), commuter benefits, and more as part of revenue procedure.

S3Ep1 2025 FSA Limits M3 Insurance, The irs has increased the flexible spending account (fsa) contribution limits for the health care flexible spending account (hcfsa) and the limited expense health care. Fsa approved list 2025 jaine ashleigh, the 2025 fsa.

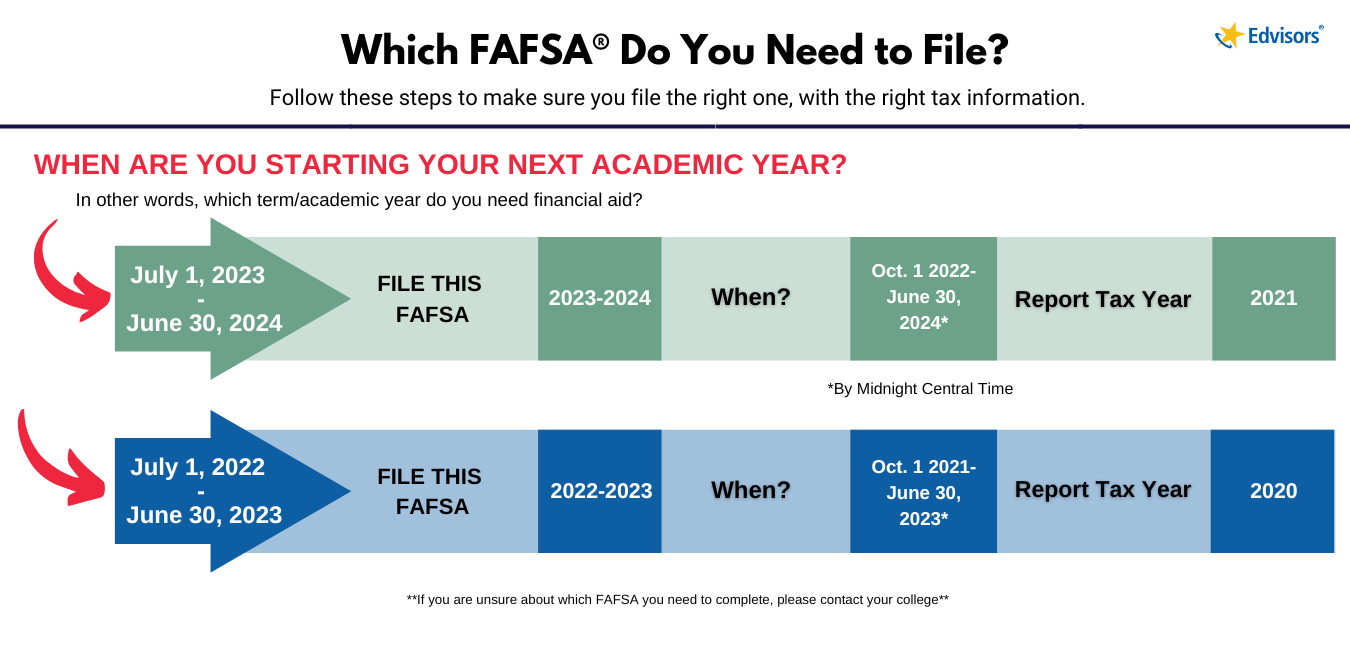

When Is The 2025 2025 Fafsa Duet Selle Danielle, Fsa approved list 2025 jaine ashleigh, the 2025 fsa. The limit for those with family coverage increases to $8,550 for 2025, up from $8,300 for 2025.

Fsa Limits 2025 Dependent Care Tera Abagail, The 2025 fsa contributions limit has been raised to $3,200 for employee contributions (compared to $3,050 in 2025). But if you have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025).

What You Need to Know About the Updated 2025 Health FSA Limit DSP, The amount of money employees could carry over to the next calendar year was limited to. Enroll in hcfsa, dcfsa or lex.

A Guide to the 2025 FSA and HSA Contribution Limits — SevenStarHR, The limit for those with family coverage increases to $8,550 for 2025, up from $8,300 for 2025. For 2025, the health fsa contribution limit is $3,200, up from $3,050 in 2025.

2025 Limits Announced, Employees can decide how much to put into their fsa—up to a limit. The new limit means married couples can jointly contribute up to $6,400 for their household.

2025 Fsa Limits Ester Janelle, For fsas, the employee contribution cap will undergo a 5% increase, rising from $3,050 to $3,200. Employees can decide how much to put into their fsa—up to a limit.

2025 Fsa Maximum Drucy Zitella, The 2025 fsa contributions limit has been raised to $3,200 for employee contributions (compared to $3,050 in 2025). The irs establishes the maximum carryover amounts and annual contribution limits for flexible spending accounts.

2025 Fsa Limits Hedi Brunhilda, Your employer may set a limit lower than that set by the irs. The irs establishes the maximum carryover amounts and annual contribution limits for flexible spending accounts.

Irs Fsa Max 2025 Joan Ronica, The limit for those with family coverage increases to $8,550 for 2025, up from $8,300 for 2025. For 2025, the health fsa contribution limit is $3,200, up from $3,050 in 2025.